Industry Talk

Regular Industry Development Updates, Opinions and Talking Points relating to Manufacturing, the Supply Chain and Logistics.Artificial Intelligence Helps In Detecting Ecommerce Fraud

Web crimes and scams are common issues these days due to technological advancements. Amongst them, eCommerce fraud has become a severe problem due to the rise of digitalization. Some decades ago, the eCommerce industry was still in its recent phase. However, times have changed substantially since then as people demand more online shopping as convenient to them. This has given rise to eCommerce frauds as well.

Well-known eCommerce service providers have to handle tons of orders each day. Of these orders, several are CNP (Card-not-present) purchases, which are more challenging to validate than transactions where the card & cardholder are present. LexisNexis Risk Solutions study found eCommerce fraud is up to 7 times harder to mitigate than fraud in person. Therefore, eCommerce businesses need to spend on a reliable fraud prevention system. Failing to do the same can result in severe losses.

Juniper Research says the CNP fraud could cost online merchants over $71 billion in the next few years. This article will shed light on eCommerce fraud and how to mitigate it with eCommerce fraud detection solutions boosted by AI.

What is E-commerce fraud?

eCommerce fraud happens when an unofficial transaction occurs in an eStore. Fraudsters usually use the compromised details of a fake or stolen credit card to perform such transactions, which means that the retailer will be left without legal payment for the bought item. Therefore, the store will have to charge the money back to the compromised customer.

eCommerce frauds can occur with orders that are COD & pre-paid too. Several types of online shopping fraud can be observed these days. Some common types of eCommerce frauds are below:

- Return To Origin (RTO)

The users ask for a return after the item has been delivered. They will utilize it for some time and then swap it with a damaged item. They might also claim never to have received the item.

- Promo-code Abuse

A single user will register several times on an app to get discounts via promo codes.

- Classic Fraud

Fraudsters will buy or steal a victim’s credit card info from the Dark Web. This method is normally adopted by novice fraudsters.

- Triangulation Fraud

This includes a legal shopper, fraudsters, and an eCommerce retailer. Deceivers will set up an online shop at eBay or Amazon. This eStore will sell high-demand items at unusually low costs. On obtaining the card info from the users, the deceiver will buy goods from a legal shop to send them to the users.

- Interception Fraud

Here, deceivers will make an order where the billing & shipping address matches the card’s address. Later, they will try to intercept the package before it reaches the address.

- Card Validity Testing Fraud

Here, deceivers will examine different card information to disclose if the credentials are valid and later use them at other sites to make unofficial charges.

- Chargeback Fraud

Here, users will make an online order and request a chargeback since their card was stolen. This usually occurs once the item has been delivered. This type of fraud is hard to detect.

Fraud Detection with AI

Using traditional methods is not a good idea because of its rigidity and non-versatility. Some factors might indicate an order is fraudulent. For instance, a user might have made an unusual amount of orders in the past few minutes. The user has inserted a fake address in the address fields or has missed the necessary details required for order delivery, resulting in an order delivery RTO.

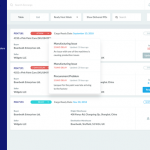

People can’t assess each factor & ascertain their contribution to the fraudulent order manually. But, AI models can come up with intricate rules in a short time and thus lessen cost, time, and manual labor on this task. Usually, there are 2 types of ML algorithms used in such AI solutions- supervised & unsupervised. Both of thesecan be seen in fraud detection & prevention systems.

ML algorithms assess transactions & threat scores, typically between 0 & 1. This score is then ranked against a pre-set limit that will mark the transaction as having very tough characteristics from legal ones. ML algorithms can identify these patterns in the data, allowing them to detect orders from deceivers.

AL solutions evaluated 100s of data points from millions of transactions to recognize patterns that might include fraud. They mostly find patterns that humans would miss. Once an AI algorithm detects an unusual order, it will either naturally block it or refer it to a human professional for proofreading.

In the eCommerce sector, online merchants have to manage massive datasets. Thus, ML algorithms & models are essential for them to function effectively. These algorithms can assess massive numbers of transactions promptly & are always analyzing and processing new datasets. Since the sector totally depends on the web connectivity and banking for online purchasing, it is prone to deception. The ML model gets more precise and efficient with massive datasets as it can differentiate & ease various behaviors.

For detecting and mitigating eCommerce fraud, the ML model helps in this process by collecting and categorizing data, then catering to training sets to foresee the likelihood of fraud.

Advantages of AI in fraud detection

- Real-time data processing

AI algorithms consider changes in real-time and act upon a fraudulent activity even before the attack, unlike traditional systems that perform when fraud has already taken place.

- Finding hidden patterns

An AI solution is great at finding hidden correlations beyond humans capabilities. Moreover, it becomes better at finding new scenarios and mitigating them with each discovered threat.

- Proxy & VPN detection

Official shoppers do not use VPNs while buying products. ML models can detect VPNs and proxies, which can help most deceptive transactions have this one commonality.

- Consistent Outcomes

Human errors are totally standard & occur often. But, ML algorithms don’t make any errors at all and promise total accuracy. This enables consistent security to businesses.

- Behavior analytics

ML algorithms register the usual behavior of every user. Hence, it is easy for them to notice any deviations & identify suspicious behavior.

- Fast & Precise Verifications

Automated verification can accelerate the entire buying process for the customer & run on defined rules, removing human errors.

Obviously, if online merchants want to mitigate significant losses that occur through fraud, they need to consider spending in an eCommerce fraud detection system boosted by AI. This will enhance the accuracy of identifying fraud and mitigate them from occurring in the future.

Author Bio:

Harnil Oza is CEO of Hyperlink InfoSystem, one of the leading app development companies in New York and India, having a team of the top app developers 2021 who deliver the best mobile solutions mainly on Android and iOS platforms. He regularly contributes his knowledge on leading blogging sites.